Helping Spanish Bank Upgrade

Their Digital Displays

In August 2024, we received an inquiry from a well-known Spanish bank. They wanted to leverage commercial displays to reshape their branch environment, adapting to the needs of modern customers and thereby improving the bank's overall service capabilities.

After initial collaboration, we held several online meetings to gain a deeper understanding of the bank's operating model. The European financial environment places a strong emphasis on privacy and efficiency, but their branches currently relied on paper-based operations and manual outreach, leading to delays in some services. After understanding the client's needs, we began formally deploying a professional digital signage solution for the bank.

Before the project started, the average waiting time at bank branches during peak hours reached 18 minutes. Customer satisfaction surveys showed a satisfaction rate of only 72%. Staff handled 40% of their workload with repetitive inquiries daily, leading to inefficiency.

While branch traffic was stable, conversion rates were low, and many customers left due to inconvenience. Space utilization was also problematic, with some areas underutilized and frequent congestion at the entrance.

Three months after deploying digital signage, the bank's statistics showed that average customer wait times decreased to 8 minutes, efficiency improved by 55%, customer satisfaction rose to 88%, and self-service usage increased by 30%.

Furthermore, navigation complaints decreased by 70%, traffic conversion rates increased by 25%, and the bank's report showed a 15% increase in the proportion of younger customers, demonstrating the role of digitalization in attracting new customer groups. These data, based on three months of monitoring, demonstrate sustainable improvement.

![]() Retail Digital Display Solution

Retail Digital Display Solution![]() Public Transportation Digital Signage Solution

Public Transportation Digital Signage Solution![]() Entertainment Digital Display Solution

Entertainment Digital Display Solution![]() Healthcare Digital Display Solutions

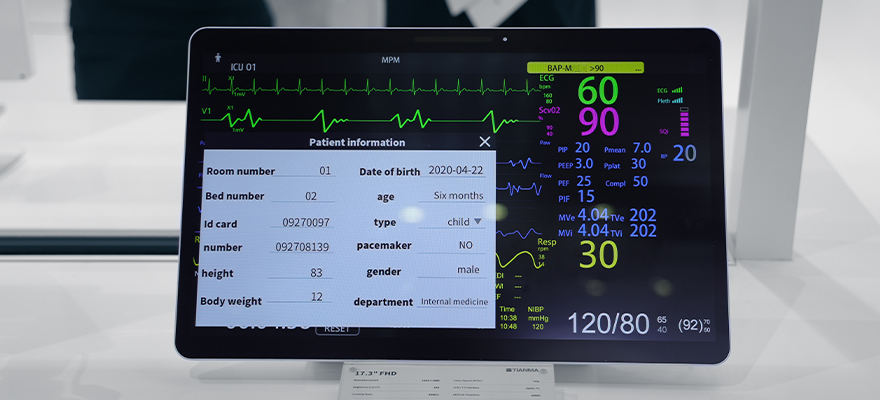

Healthcare Digital Display Solutions![]() Education Digital Signage Solutions

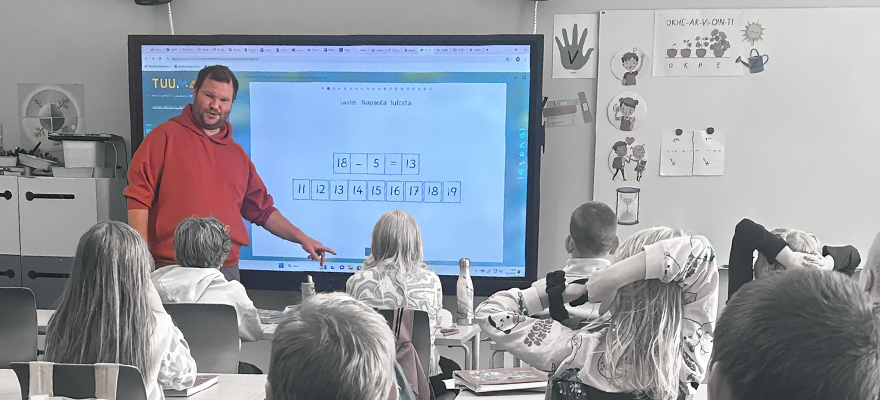

Education Digital Signage Solutions![]() Corporate Digital Display Solutions

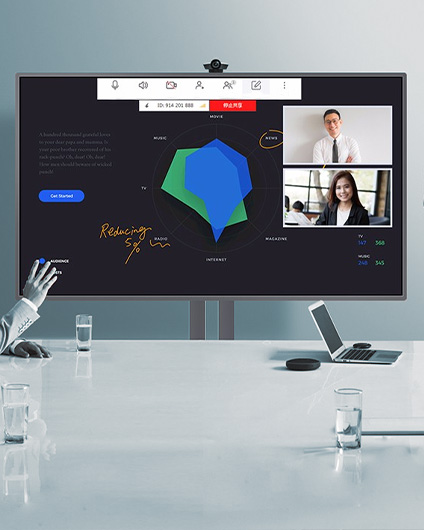

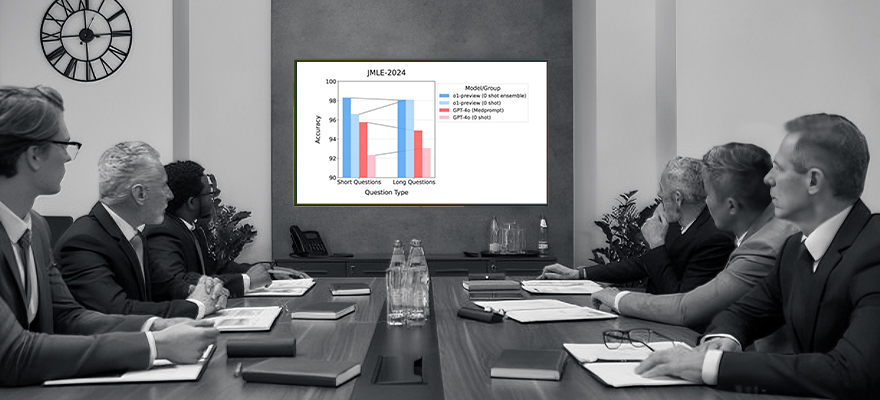

Corporate Digital Display Solutions![]() Art Digital Display Solution

Art Digital Display Solution![]() Industrial Digital Display Solutions

Industrial Digital Display Solutions![]() Hotel Digital Signage Solutions

Hotel Digital Signage Solutions![]() Outdoor Digital Signage Solutions

Outdoor Digital Signage Solutions